In Wisconsin, there are a range of different trust structures available to best suit your specific estate planning needs and circumstances. Common types of trusts include revocable trusts and irrevocable trusts, but there are a variety of options to explore to serve your unique purpose. Given the complex rules and regulations accompanying trusts, it is important to consult with an experienced trust attorney in Wisconsin to find the best trust for your specific needs.

Trusts are powerful estate planning tools that allow one party (the trustee) to hold properties or assets for the benefit of another party (the beneficiary). Trusts are created by a grantor/settlor who transfers some or all of their assets into the trust for the trustee to be responsible for.

Revocable Trusts | Irrevocable Trusts | Special Needs Trusts | Irrevocable Life Insurance Trusts | Charitable Remainder Trusts | Charitable Lead Trusts | Testamentary Trusts | Spendthrift Trusts

To receive means-tested public benefits such as Medicaid and Supplemental Security Income (SSI), people with disabilities cannot exceed an Asset Limit, which is the amount of available assets in excess of the applicable amount. However, assets held in a Special Needs Trust with the disabled individual as the beneficiary do not count toward their Asset Limit. The assets in the trust cannot be paid directly to the beneficiary and must only be used for things the beneficiary cannot obtain through public benefits; otherwise, the disabled individual’s public benefits will be discontinued.

An irrevocable life insurance trust allows the grantor to remove taxable assets from their estate and transfer them to a separate legal entity (the trust) and are powerful wealth transfer mechanisms. The trust is a legal arrangement where a trust owns a life insurance policy, rather than the insured person themself. At the time of the insured person’s death, the life insurance policy proceeds are paid to the trust and then distributed to beneficiaries as the trust outlines.

The trust is irrevocable, meaning that the grantor forfeits all rights to the property contained in the trust, which allows the assets to potentially avoid estate taxation as they are not considered one’s property. An irrevocable life insurance trust also helps with asset protection as creditors should not be able to attack the assets because they belong to the trust, not you. It can also help with funeral or other estate expenses by providing liquid assets that aren’t tied up in a business, real estate, or retirement accounts.

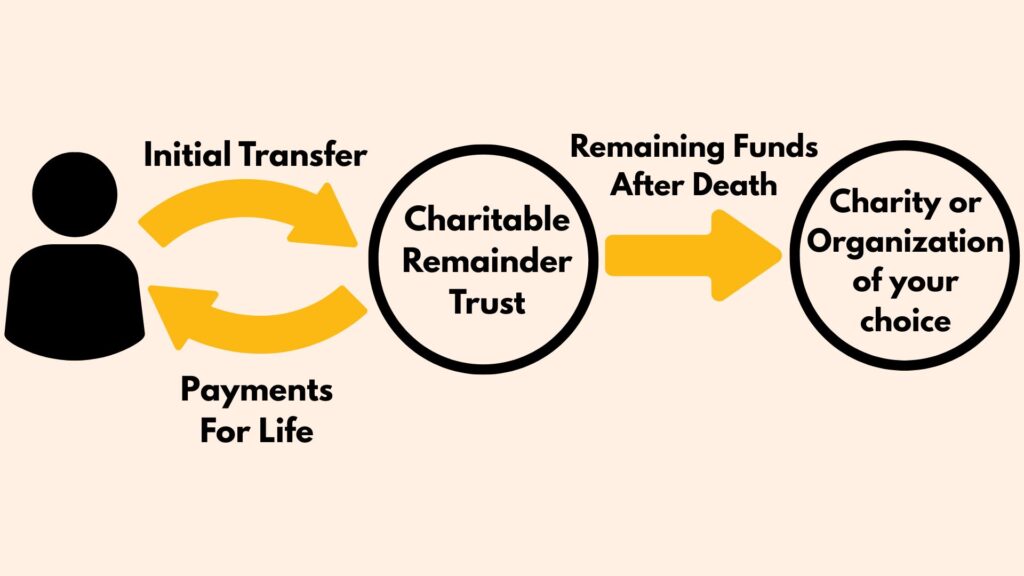

Charitable Remainder Trusts allow you or other named beneficiaries to receive a certain predetermined amount in the form of reliable payments from the trust for life or up to 20 years. Then, the remaining balance of the trust goes to a charity organization of your choosing. The Charitable remainder trust is best suited for beneficiaries who depend upon the money from the trust as their main source of income. On the other hand, a Charitable Lead Trust outlines a certain amount of its income to a charitable organization and the remains will be disbursed to the beneficiaries, putting the focus on the charity rather than its beneficiaries unlike the Charitable Remainder Trust.

Charitable Remainder Trusts are irrevocable, meaning that it is extremely difficult to amend or terminate early once it has been established. The Charitable Remainder trust also offers some benefits, such as tax benefits available immediately to the donors of the trust after its creation and other benefits when it comes to reducing estate taxes.

There are two types of Charitable Remainder Trusts: annuity trusts and unitrusts. An annuity trust pays you the same dollar amount each year that you choose at the start and payments remain the same regardless of fluctuations in trust investments. The unitrust, on the other hand, pays you a variable amount based on a fixed percentage of the fair market value of the trust assets. So, if the value of the trust increases, your payments increase; but, if the value decreases, your payments decrease.

A testamentary trust only becomes effective after the death of the grantor and is created as part of the grantor’s will. Because the trust is part of the grantor’s will, unlike other types of trusts, a testamentary trust must go through probate. In Wisconsin, probate can take 12 to 18 months, or even longer, to complete, includes fees, and is public information. A testamentary trust is often used when the beneficiaries are minors, have special needs, or need financial protection. It allows the grantor to set specific conditions and timelines for when and how the assets will be distributed to the beneficiaries

A testamentary trust allows the grantor to retain control of their assets while they are alive, and they are able to change the terms of the trust whenever they choose to do so. However, once it is established when the grantor dies, it typically becomes irrevocable, and the trust must be administered by the trustee in the way the trust requires. This also requires a trustee, the individual responsible for administering the trust, who is trustworthy and dependable.

Spendthrift trusts limit a beneficiary’s access to the assets in the trust and can help protect them from creditors. A spendthrift trust is best suited for beneficiaries that you may have concerns about being “bad with money” or unable to responsibly manage their wealth. Creditors cannot access trust funds or assets and beneficiaries cannot take loans out against the trust funds.

The beneficiary of a spendthrift trust is never the trustee, meaning they are not responsible for the assets in the trust. The trustee can spend the money for the beneficiary’s needs to make payments directly to the beneficiary depending on what the trust document allows. Spendthrift trusts are structured to prevent the beneficiary to be wasteful of their trust fund and some are even set up to grant the trustee the power to cut off benefits of a beneficiary who becomes self-destructive, such as with their use of drugs or alcohol.

It is essential to hire an experienced Wisconsin Trust attorney to help navigate the complex legal and tax issues that come with trusts to best ensure that your family and assets are protected. Contact Konstantakis Law Office today to learn what trusts are best for your estate planning needs.

COPYRIGHT © 2024 KONSTANTAKIS LAW OFFICE, LLC - ALL RIGHTS RESERVED.