Wisconsin Irrevocable Trusts Lawyer

What is a irrevocable trust?

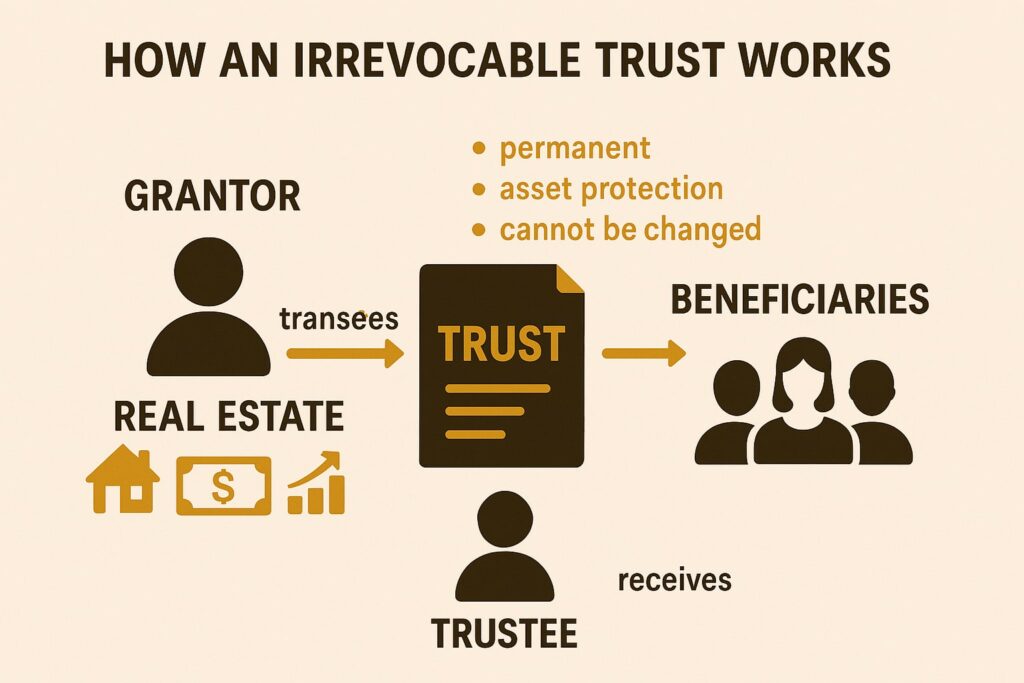

Irrevocable trusts are powerful, complex estate planning tools that transfer ownership of assets from an individual to the trust. A trustee is then responsible for the administration of the trust for the benefit of another party (the beneficiary. Unlike its revocable counterpart, an irrevocable trust cannot be changed or revoked (with some very limited exceptions). An irrevocable trust offers a range of tax benefits and asset protections.

A key item to note with irrevocable trusts is that the grantor permanently relinquishes ownership and control of the assets transferred into the trust. The grantor typically cannot revoke or significantly alter the trust after its creation (with few exceptions). By surrendering control, the grantor may achieve goals such as:

- Estate tax minimization

- Asset protection from creditors

- Medicaid eligibility planning

Grantor/Settler

The grantor or settlor is the person who creates the trust and whose assets are included in it.

Beneficiary

The beneficiaries are the individuals who will receive the income or assets from the trust.

Trustee

The trustee is the person who is responsible for managing the property and assets within the trust. It is best to select a trustee who has the proper training and qualifications to carry out their duties, including managing the property, filing tax returns, paying out income from the trust to beneficiaries, and distributing property to beneficiaries after you die. Trustees are legally required to act in the best interest of the beneficiaries and are held accountable for their actions.

Unlike a revocable trust, the grantor cannot name themself as the trustee. You should also name one or more successor trustees to take over the responsibilities if the first trustee dies or is unable to fulfill their duties. If you name two or more people to act together as trustees, they are called “co-trustees”; however, it is recommended to only appoint individual trustees. Read more about the common problems of co-trustees here.

Example:

"John knew he had considerable amounts of debt by placing his assets into an irrevocable trust, John ensured his wealth would be protected for his children's future, shielding it from estate taxes, potential creditors, and unforeseen liabilities. This strategy provided peace of mind, knowing his legacy was secure, tax-efficient, and precisely managed according to his wishes."Attorney Konstantakis

Advantages of a Irrevocable Trust in Wisconsin

Tax Benefits

Assets in an irrevocable trust are no longer considered part of your taxable estate because they are considered to be owned by the trust and not by you. This can significantly lessen the estate taxes on your assets and offers a considerable advantage to maximize the available inheritance to the beneficiaries.

Asset Protection

The trust’s ownership of the assets instead of the grantor’s ownership also offers asset protection. This includes protection from creditors, judgements, and divorce. So, if you are sued, creditors cannot use the assets in your irrevocable trust to satisfy a legal obligation, thus irrevocable trusts are an important tool for those in highly litigious careers.

Avoids Probate

In Wisconsin, probate can take 12 to 18 months, or even longer, to complete, includes fees, and is public information. By creating an irrevocable trust, you can ensure your wishes are followed and assets are distributed according to your preferences without having to go through the lengthy probate process. Additionally, the irrevocable trust offers privacy benefits because it doesn’t go through probate, which is a matter of public record. By skipping probate, the irrevocable trust also shortens or eliminates delays in the distribution of your property to the beneficiaries of the trust. This does not certify that an irrevocable trust will simplify all problems with going through probate. It is best to work with an estate planning attorney that knows the facts.

Disadvantages of a Irrevocable Trust in Wisconsin

Lack of Control

The grantor (the person who creates the trust) cannot be the trustee (the person who manages the trust). According to Wisconsin law, the grantor loses ownership of the assets in the trust and the responsibility to manage these assets is passed on to the trustee.

Lack of Flexibility

Once the irrevocable trust is established, changes are next to impossible to make. This includes changes in beneficiaries. Circumstances can change but an irrevocable trust does not offer the flexibility to be able to adapt to these changes.

To make changes or to terminate the trust, you usually need the consent of all parties, including all beneficiaries and trustees, and possibly a court order. Judges are more inclined to make changes or terminate an irrevocable trust when it is obvious the purpose of the trust has been fulfilled, has become illegal, or is defeated by compliance with the terms of the trust.