Revocable Trusts Lawyer in Wisconsin

What is a revocable trust?

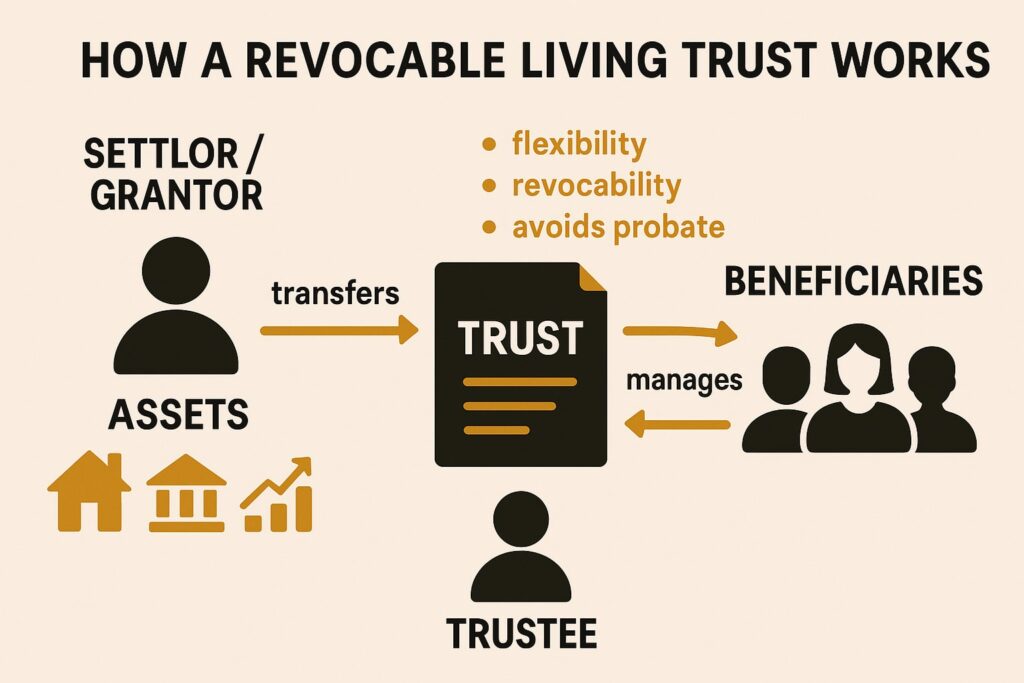

Trusts are powerful estate planning tools that allow one party (the trustee) to hold properties or assets for the benefit of another party (the beneficiary). Trusts are created by a grantor/settlor who transfers some or all of their assets into the trust, which is managed by another party, called the trustee. A revocable trust, also called a living trust, allows you to put into writing how you want the property and assets you put into the trust to be managed and distributed during your life and after your death. Unlike an irrevocable trust, a revocable trust can be changed or revoked. The revocable trust also can help avoid probate, provide for you loved ones after your death, and protect your assets.

Grantor/Settler

The grantor or settlor is the person who creates the trust and whose assets are included in it.

Beneficiary

The beneficiaries are the individuals who will receive the income or assets from the trust. If you create a revocable trust, you are entitled to also hold the beneficiary role and use the trust property and income during your lifetime. Uniquely, a revocable trust is the only trust that allows you to hold all 3 positions at the same time.

Trustee

The trustee is the person who is responsible for managing the property and assets within the trust. It is best to select a trustee who has the proper training and qualifications to carry out their duties, including managing the property, filing tax returns, paying out income from the trust to beneficiaries, and distributing property to beneficiaries after you die.

The grantor typically names themself as the trustee because they want full control over the property while they are alive. You should also name one or more successor trustees to take over the responsibilities if the first trustee dies or is unable to fulfill their duties. If you name two or more people to act together as trustees, they are called “co-trustees”; however, it is recommended to only appoint individual trustees. Read more about the common problems of co-trustees here.

Example:

"A revocable living trust is ideal for clients like John and Mary, a retired couple who want to avoid probate and ensure their assets pass smoothly to their children. By placing their home and investments in a trust, they maintain control during their lifetime and avoid court delays if they become incapacitated or pass away. It’s a smart move for anyone looking to simplify estate administration and protect their privacy."Attorney Konstantakis

Advantages of a Revocable Trust in Wisconsin

Avoids Probate

In Wisconsin, probate can take 12 to 18 months, or even longer, to complete, includes fees, and is public information. By creating a revocable trust, you can ensure your wishes are followed and assets are distributed according to your preferences without having to go through the lengthy probate process. Additionally, the revocable trust offers privacy benefits because it doesn’t go through probate, which is a matter of public record. By skipping probate, the revocable trust also shortens or eliminates delays in the distribution of your property to the beneficiaries of the trust.

Manages your Assets

With a revocable trust set up, if you become too ill or disabled to manage your property, your trustee or successor trustee can manage it for you. A will and a revocable trust both allow you to direct how your property will be distributed after you die and provide for your beneficiaries. However, a revocable trust allows you to include instructions about how you want your property managed if you become disabled or unable to during your lifetime.

Flexibility

Revocable trusts can be structured to specify how and when your assets will be distributed to beneficiaries and offer more flexibility than a will. Revocable trusts also can include instructions for your care if you become incapacitated. However, you will still need to create an advance directive, including a living will and healthcare power of attorney, to comprehensively communicate your preferences. In addition, a revocable trust offers more flexibility than an irrevocable trust because it can be changed or revoked. Changes can be made for any reason at any time, and you don’t need permission from anyone to do so. In Wisconsin, a trust is revocable only if it says so in the trust agreement and the trust will become irrevocable when you die, so no further changes are allowed.

Disadvantages of a Revocable Trust in Wisconsin

Doesn’t eliminate the need for other estate planning documents

A comprehensive estate plan has a range of documents to ensure that your wishes are followed. Creating a revocable trust does not eliminate the need for a will or durable power of attorney. If you have a revocable trust, you also need to create a pour-over will to transfer property that wasn’t originally in the trust into the trust after your death. A durable power of attorney is still necessary to appoint an agent to manage all of your assets. A trustee can only make decisions about property already in the trust.

Still part of Taxable Estate

While there are advantages to the ability to change or terminate the trust, this also means that the assets in the trust are still part of your taxable estate. Thus, a revocable trust does not offer the same estate tax benefits as an irrevocable trust and does not protect assets from creditors.

Hiring a Wisconsin Revocable Trust Attorney

An experienced Wisconsin Revocable Trust Attorney can help customize the trust to meet your unique needs and specific circumstances and ensure that your estate plan is thorough and well-rounded. Contact us today or give us a call!